child tax credit november 2021 direct deposit

File a federal return to claim your child tax credit. The last payment for 2021 is scheduled for Dec.

Child Tax Credit 2021 8 Things You Need To Know District Capital

Because the CTC is a tax credit for the 2021 tax year children born in the current calendar year qualify for the payments.

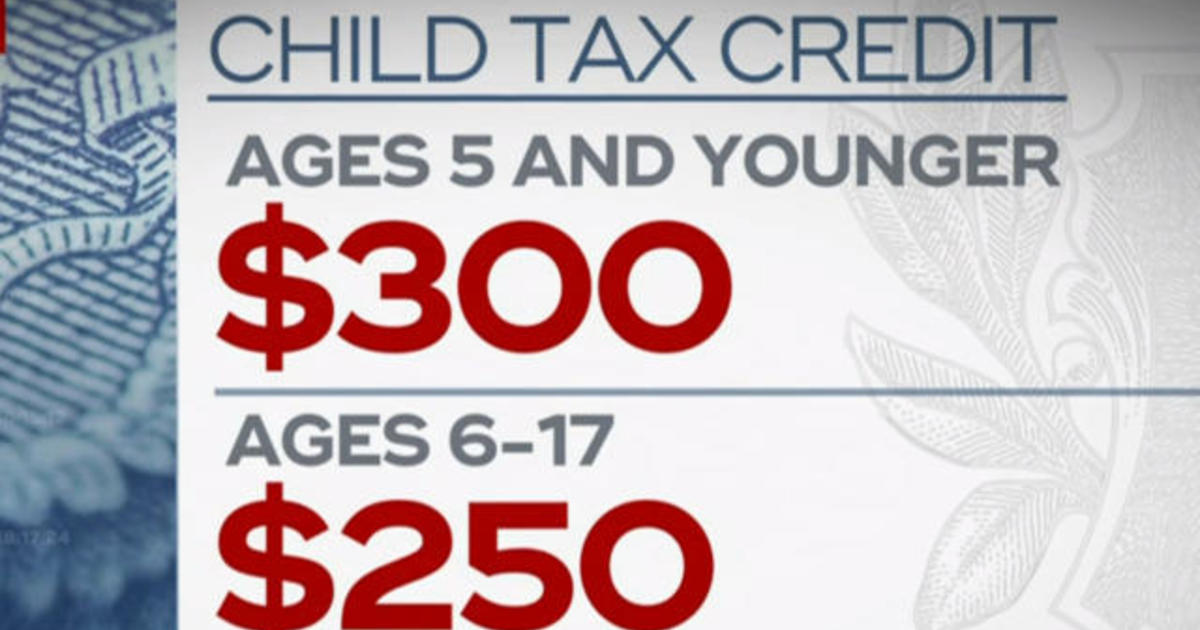

. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. For those who claimed early the IRS has been sending families half of their 2021 child tax credit as monthly payments of 300 per child under six and 250 per child between the ages of six and 17. Up to 300 dollars or 250 dollars depending on age of child.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Up to 1800 dollars or 1500 dollars depending. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

But many parents want to. Get all the information related to Change Direct Deposit For Child Tax Credit - Make website login easier than ever. Another phaseout would drive the child tax credit below 2000 for each child and thats when the modified adjusted gross income is above 400000 for married couples and 200000 for all others.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Youll need to print and mail the. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for children.

Most families will receive the full amount which is 3600 for each child under age six and 3000 for each child ages six to 17 in 2021. August 13 September 15 October 15 November 15 and December 15. Families will see the direct deposit payments in.

IR-2021-222 November 12 2021. For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Low-income families who are not getting payments and have not filed a tax return can still get one but they.

Simple or complex always free. With direct deposit families can access their money more quickly. At first glance the steps to request a payment trace can look daunting.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their advance Child Tax Credit CTC payment for the month of November. November 12 2021 1126 AM CBS Chicago. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per.

Tax returns processed by June 28 will be reflected in the first batch of monthly payments scheduled for July 15. Check mailed to a foreign address. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Dates As Irs Set To Send Out New Payments

Why Is There No Child Tax Credit Check This Month Wusa9 Com

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit Delayed How To Track Your November Payment Marca

Child Tax Credit When Will Your November Payment Come Cbs Baltimore